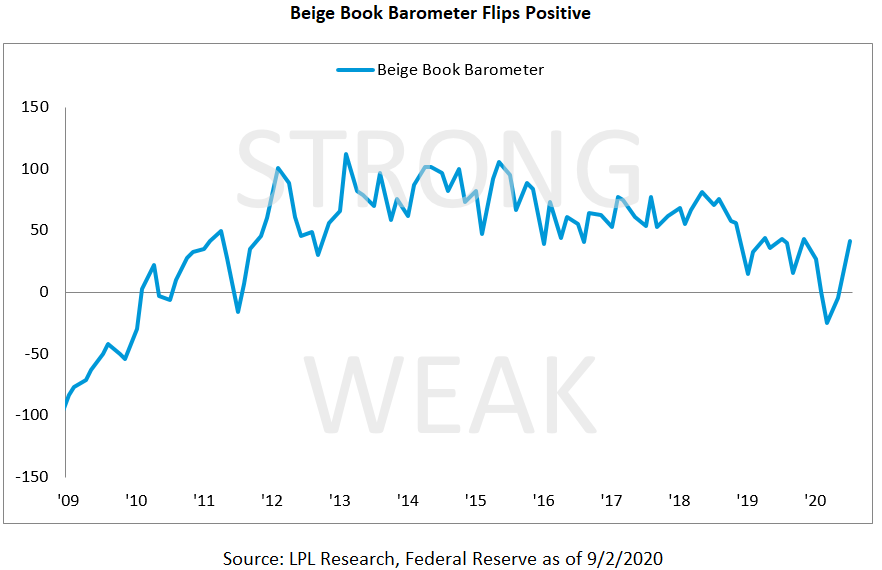

The outbreak of COVID-19 caused considerable deterioration in the economy and left many wondering when we might expect conditions to improve. As historic stimulus measures were implemented to backstop the economy from outright collapse, many also wondered if this would be enough to restore sentiment to a level where economic activity would follow. We are now seeing the first stages of improving sentiment based on the results of the most recent Federal Reserve (Fed) Beige Book.

In the Beige Book, the Fed presents qualitative observations made by community bankers and business owners—or “Main Street”—about economic (housing, labor market, manufacturing, nonresidential construction, prices, tourism, wages) and banking conditions (lending conditions, loan demand, loan quality). At LPL Research, we maintain an indicator called the Beige Book Barometer (BBB) to gauge Main Street’s sentiment by looking at how frequently key words and phrases appear in the text.

As the LPL Chart of the Day shows, the Beige Book Barometer has flipped into positive territory for the first time since the beginning of the recession, suggesting sentiment is firmly on the rise.

Strong words rose by 34, the second most increase since we began tracking the data in 2005, while weak words declined by 13. The notable rise in strong words mainly referenced the improvement in manufacturing activity and the residential real estate market, which continues the theme shown by recent new home sales and housing starts data. Broader economic activity grew at a modest pace along with a pick up in consumer spending—though still below pre-pandemic levels.

However, while the general outlook was mostly optimistic, survey results pointed toward continued uncertainty in the path of the pandemic, and its effect on consumer and business activity was echoed across the country. We continue to see caution in the labor market, which despite further improvement, may point toward an uneven recovery should economic demand falter. As weekly jobless claims data has ebbed and flowed, this Friday’s nonfarm payrolls report should be key to determining the health of the labor market. Stay tuned to the LPL Research blog for updates.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-00515165