COVID-19 cases have been on the rise in the US, particularly in the Midwest. This latest wave of the virus and related restrictions have begun to hamstring economic growth at a time when momentum was already fading as we entered the fourth quarter, based on the December iteration of the Federal Reserve (Fed)’s Beige Book.

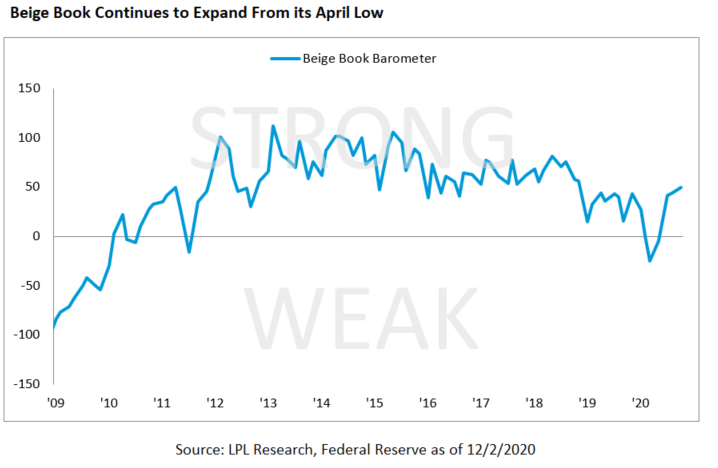

In the Beige Book, the Fed presents qualitative observations made by community bankers and business owners—or “Main Street”—about economic (housing, labor market, manufacturing, nonresidential construction, prices, tourism, wages) and banking conditions (lending conditions, loan demand, loan quality). At LPL Research, we maintain an indicator called the Beige Book Barometer (BBB) to gauge Main Street’s sentiment by looking at how frequently key words and phrases appear in the text.

There were no new revelations in the industry segments, as housing and manufacturing activity remain robust while the retail, leisure, and hospitality sectors remain under pressure. As shown in the LPL Chart of the Day, the Beige Book Barometer rose for the fourth straight iteration since April, as economic momentum continued despite rising COVID-19 cases:

However, about a quarter of the Fed’s survey respondents cited little to no growth in their district. In particular, recent COVID-19 hotspots in the Midwest noted that economic activity began to slow in early November as cases surged—affirming our view in Weekly Market Commentary COVID-19 May Threaten the Recovery.

“While the economy has come a long way, we’re not out of the woods yet, and rising COVID-19 cases present a risk for an economic soft-patch as we head into 2021.” Added LPL Chief Market Strategist Ryan Detrick.

The Beige Book also revealed that momentum in the labor market has stalled—raising fear unemployment could rise through the winter—and some companies are finding it difficult to hire as childcare and other health concerns are creating labor-supply issues. The good news for workers has been that companies are seeing increased pressure to raise wages for low-skilled employees—a segment of the labor market that has been particularly affected by the outbreak of COVID-19.

A curious development was the rather widespread citation of supply disruptions and rising transportation costs, which have largely been passed on to consumers. When the management of COVID-19 improves, lifting consumer confidence and spending, this could set the stage for greater inflationary pressure.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and Bloomberg.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05085518