We continue to monitor real-time COVID-19 and economic data to provide insight into how the pandemic is affecting economies around the world. Traditional economic data sometimes can be too slow to pick up the changes that are occurring. Today we focus on Europe.

“The high-frequency data shows that the recovery from COVID-19 related economic disruption is happening at a different pace in different parts of the world,” said LPL Financial Chief Market Strategist Ryan Detrick. “Governments globally, but especially in Europe, are struggling with managing reopening economies while also controlling the spread of the virus.”

In recent weeks much of Europe has been facing a sharp increase in COVID-19 infections: Over 700,000 new cases were reported by European nations last week, the highest number since the start of the pandemic. This has led to partial lockdowns or curfews in France, Spain, and the United Kingdom (UK) as local governments impose tougher restrictions on regions and cities with higher infection rates.

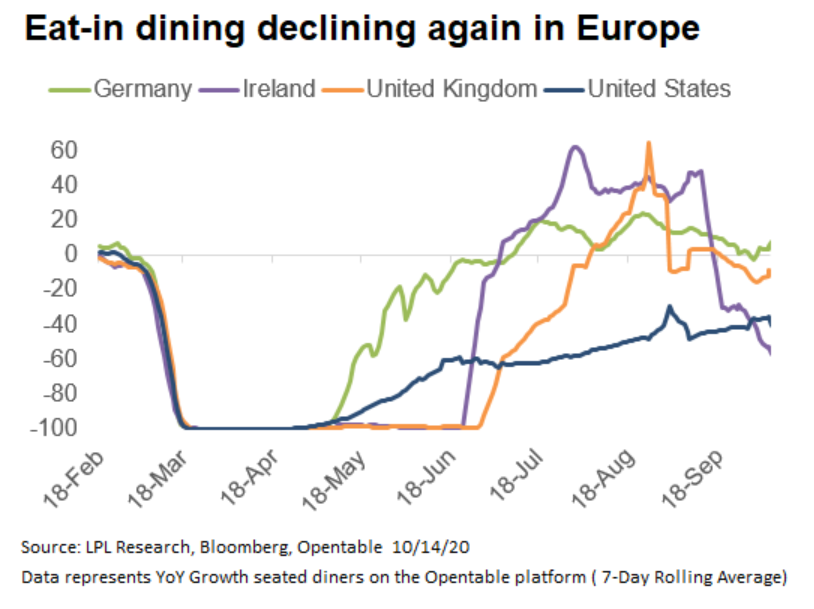

Using data from the online restaurant booking system Opentable, we see that Germany, Ireland, and the UK all quickly recovered to pre-pandemic levels once lockdown restrictions were lifted. Later in the summer, the UK and Ireland were even able to vastly outpace last year, thanks in part to local promotions such as the UK government’s “Eat Out to Help Out” campaign. However, both countries have seen recent declines in restaurant bookings as local infections have risen, people have become less comfortable eating out, and restaurants and pubs are forced to reduce hours. Germany has also seen a decline in diners since mid-summer highs. These countries’ trajectories are very different from the United States where the recovery in dining out has been slower but steady.

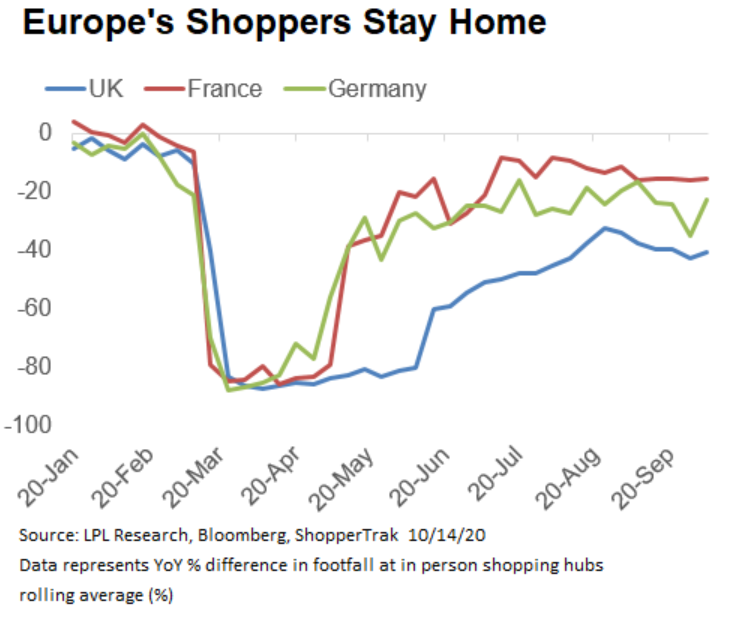

The data on the number of in-person shoppers visiting Europe’s busiest shopping centers also showed sharp recoveries after the first round of lockdowns were eased, and that the recovery has struggled to maintain momentum and seen declines since mid-August. The new lockdown measures in the UK and France will likely put further pressure on these brick-and-mortar retailers in coming weeks.

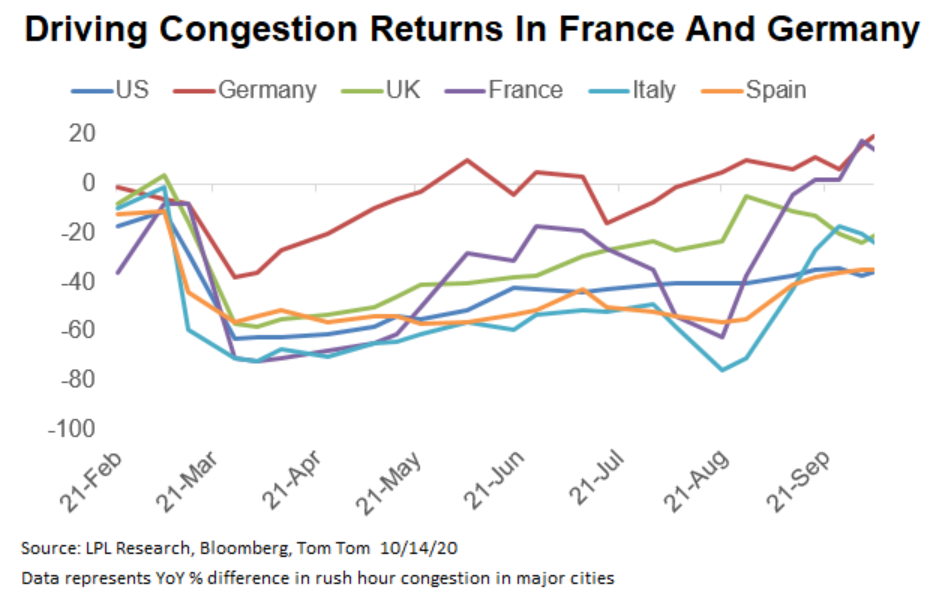

Driving congestion data, from the location technology company TomTom, shows that Germany had a relatively quick return to pre-pandemic levels of traffic and France had just reached similar levels before declining in the last week. The UK, Italy, and Spain have all shown recoveries from earlier lows, but they’ve started to level off, or decline, recently. This contrasts again with the US data that has been slowly grinding higher since the end of March.

The high-frequency data is starting to reflect the increasing spread of COVID-19 in Europe, which strengthens our view that we expect economies in Europe to contract more in 2020 than the United States or Japan, which has been supported by a very aggressive stimulus response. We continue to favor emerging markets equities over those in developed international markets, with China’s apparent success in containing the virus and reopening its economy a key factor.

LPL Research continues to monitor high-frequency data from around the globe and will keep you updated, real-time, as this changes.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05067771