The Food and Drug Administration (FDA) approval of the Johnson & Johnson vaccine on March 1 added another important tool in the fight against COVID-19. President Biden reported Wednesday that thanks to a deal with Merck & Co. to manufacture this easy to transport, single-shot vaccine, there will be enough supply to vaccinate the whole US adult population by the end of May (although getting shots in arms will take longer). There are now three approved vaccines in the United States, on top of another 13 that have been developed around the world.

“The unprecedented development and production of vaccines to combat COVID-19 have undoubtedly been a triumph of human spirit and ingenuity. Countries, including the US, with successful vaccination programs may be well-positioned to get their economies back on track sooner rather than later,” said LPL Financial Chief Investment Officer Burt White.

While the pace of the inoculation programs implemented around the world has varied greatly, one thing is becoming clear from the data: More shots equal less COVID-19.

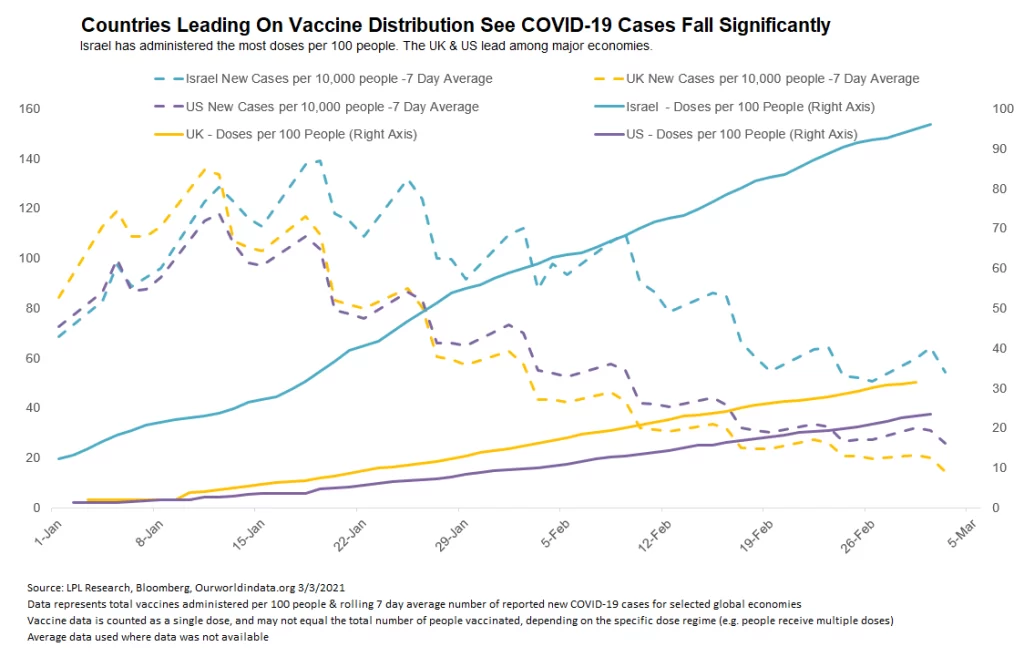

As shown in the LPL Chart of the Day, three of the countries leading so far in terms of vaccine doses administered per 100 people—Israel, the US, and the United Kingdom (UK)—have all started to see major declines in the numbers of new COVID-19 cases being reported.

Globally Israel has had the most successful vaccination rollout so far and is fast approaching 100 shots administered per 100 people with 39% of the population now fully vaccinated (including 90% of people over 50). New cases have dropped to a low enough level that local authorities recently allowed shopping malls, gyms, and hotels to reopen. Key reasons for Israel’s success include its centralized heath care system and already well-developed infrastructure for responding to large-scale national emergencies. The coming months in Israel will be the first test of which occurs first: herd immunity, estimated at 75% of the population vaccinated, or a lack of people willing to be vaccinated (demand is already falling).

The United States and the UK, both hit hard by COVID-19, have the highest vaccination rates among major economies and have both also exhibited large recent reductions in new COVID-19 cases. The UK was very aggressive in its vaccine procurement program, ordering enough for its entire population to be fully vaccinated three times over, as well as benefiting from investment in the locally developed Oxford-AstraZeneca vaccine. Signs of confidence stemming from the vaccine rollout are being felt in the UK as the government announced a plan for a complete rollback of all restrictions by June 21. In the United States, some states like Texas are moving forward with removing mask mandates and business capacity restrictions.

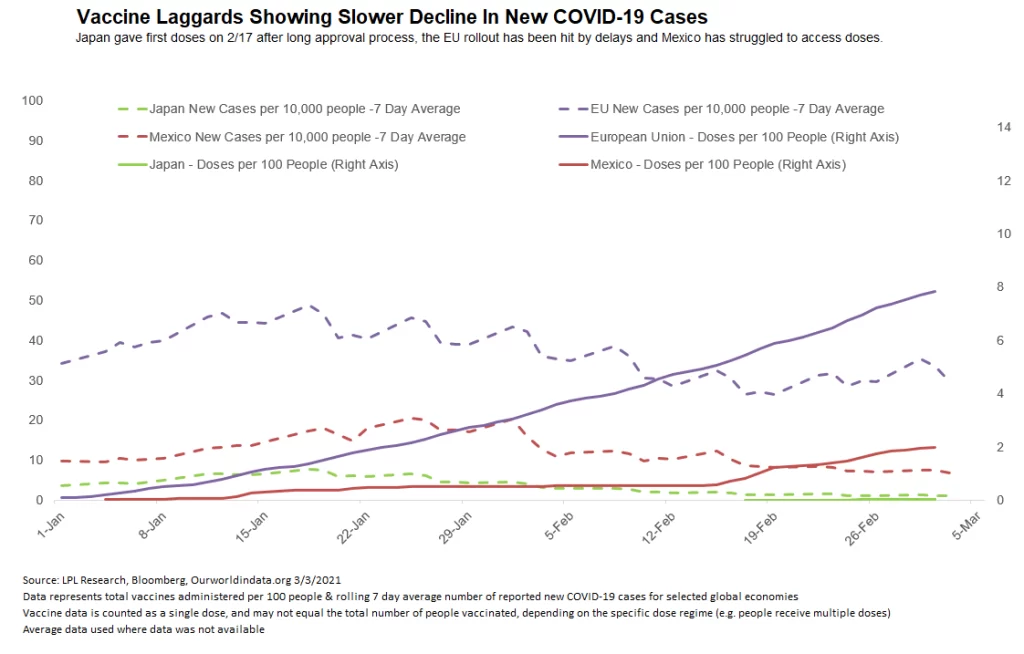

Not all rollouts have gone this well: Issues with regulatory approval, lack of public confidence, poor distribution, and limited access to supply have hampered efforts in some countries. Countries that have not made as much headway on their vaccination programs, such as in the European Union (EU), Japan, and Mexico, have not seen as large a reduction in COVID-19 cases either, as shown in the chart below.

Japan has managed to keep the actual spread of COVID-19 very low compared to many other countries, but it took two months longer than the US to approve the Pfizer shot. Japan has moved cautiously due to having one of the lowest public confidence rates in vaccines globally, dating back to vaccination health scares in the 1970s and 1980s.

The EU has struggled with supply due to issues with procurement and manufacturing delays as well as issues coordinating its response across its 27 member states (some such as Hungary have obtained Russian and Chinese vaccines not approved by European authorities). EU supply chains have improved in recent weeks and slow, but consistent, progress has been made. Mexico is struggling with supply and has barely started its vaccination program, complaining to the United Nations about unfair vaccine hoarding by the more developed economies.

While new vaccine resistant variants remain a risk, we see the progress made on vaccine deployment in the US as a tailwind for the economy and markets. We favor domestic equities over developed international equities, but the gap is narrowing. Within developed markets, we give the edge to Japan, despite its slow vaccine approval process, based on the country’s massive stimulus efforts and relative success containing COVID-19. Emerging market economies’ response to COVID-19 has been mixed, with Latin America struggling particularly, but we expect solid economic growth across Asia to support the asset class and continue to recommend an overweight allocation.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05118343