Heading into 2020, we maintained our preference for growth stocks as we believed that earnings growth would become harder to come by as the economic cycle aged, and their robust earnings growth was greatly appealing. These same growth stocks bucked historical precedent and proved to be well insulated from the economic effects of the stay-at-home environment presented by the outbreak of COVID-19. As the economy began to emerge from lockdown after the horrendous second quarter of 2020, a cyclical trend began to emerge, and we’ve slowly been warming up to value stocks as a result

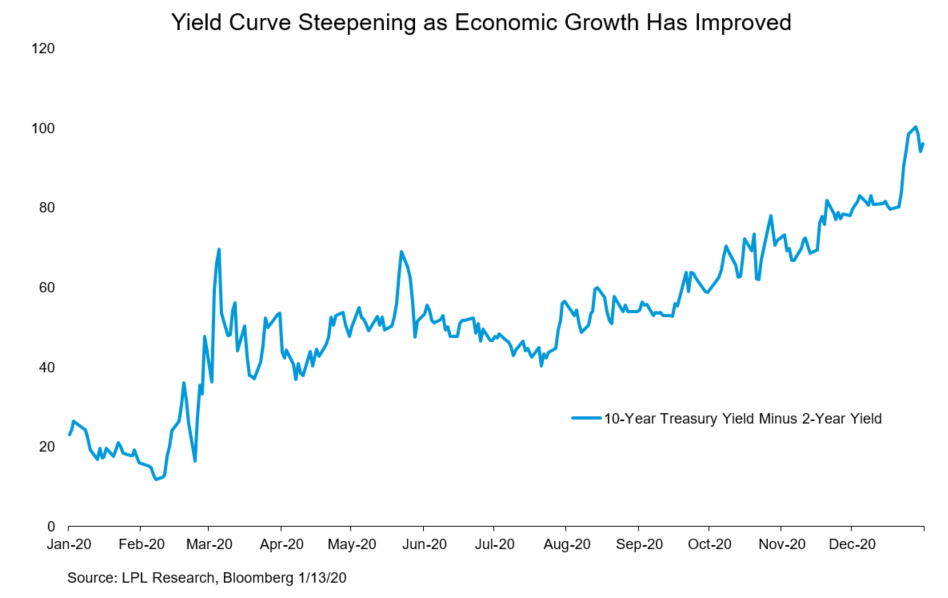

In particular, we upgraded our view of the financials sector from negative to neutral in our most recent Global Portfolio Strategy publication, supported by a steepening yield curve and rising interest rates. As shown in the LPL Chart of the Day, the yield curve has steepened more than 50 basis points (0.50%) since the summer low as investors began to price in higher economic growth and inflation, while the Federal Reserve has kept short-term rates anchored at zero.

The steeper yield curve should help the net interest margin on new loan issuance while long-term rates are rising due to better economic prospects, which should limit defaults. However, the 10-year Treasury yield remains historically low at just over 1%, and we forecast the yield to finish 2021 in the range of only 1.25–1.75%. Financials would be better off if the higher-end of our range were met or exceeded. Despite the economy being in a considerably better place than it was over the summer, the battle against COVID-19 continues to threaten the path of the recovery.

“We’ve talked a lot about cyclicals as we emerged from the lockdowns of last spring, and we expect it will continue into 2021,” noted LPL Chief Market Strategist Ryan Detrick. “The economy has been improving, but the rollout of the vaccine will be the key determinant for the economy.”

Meanwhile, we have downgraded communication services stocks from positive to neutral. Communication services, which includes internet and digital media giants Alphabet (Google), Facebook, and Netflix, has benefited from the stay-at-home environment that persisted through much of the pandemic. However, the top-heavy nature of the sector—the three largest stocks account for nearly 60% of the sector weight—leaves it vulnerable to the rotation toward cyclicals. It’s also possible that the incoming Joe Biden administration may change the regulatory landscape for these firms, presenting an additional risk going forward.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and Bloomberg.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05099807