Most economic charts we look at in the LPL Research Department look alike. Many segments of the US economy came to an abrupt halt in March when the lockdowns and business closures began, making most economic charts covering March and April look like a steep drop on a roller coaster.

Two months later, the economy is starting to pick up as states reopen. All 50 states have now reopened to some extent, but traditional economic data is too slow to pick up the change.

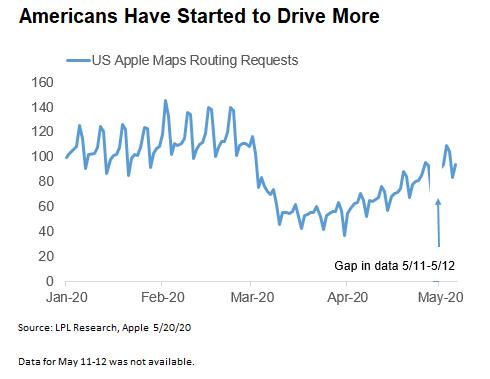

We can see the impact of the reopenings in real-time data such as map routing requests by the Apple maps app, shown in the LPL Chart of the Day. More map searches means more driving, which means more people going to work or to stores and more economic activity. Searches have doubled since the April lows. A number of other indicators are telling this same story.

“The pickup in real-time indicators such as map requests for drivers is encouraging,” said LPL Financial Equity Strategist Jeffrey Buchbinder. “This and other similar data indicate that the US economy is on the road to recovery as businesses open up and people hit the roads. You can certainly see the optimism in the stock market’s impressive rebound over the past two months.”

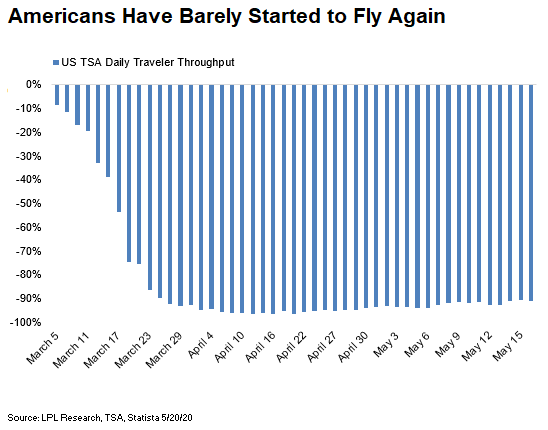

Some other real-time data has not bounced back quite so well. The number of fliers going through TSA checkpoints is still down more than 90% year over year even though the number has doubled over the past month. Driving appears to be the transportation mode of choice in a pandemic. Airlines will take quite a while to come back.

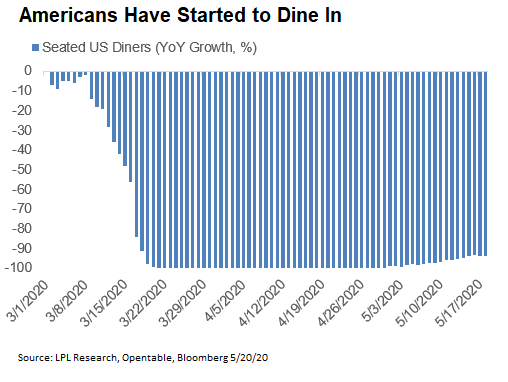

Another real-time indicator that remains quite depressed is the number of diners in restaurants, down 94% year over year. While that is up from more than 99% in late April, clearly restaurants have a long way to go to recover. Take out is helping fill the gap, but social distancing clearly puts a cap on the opportunity for restaurants.

These real-time indicators are showing that the economy is beginning to pick up some from extremly depressed levels. We will continue to watch these and other timely data for evidence that the recovery is gaining steam. We don’t know officially if the US just experienced a recession (it almost certainly did), but the timeliest data indicates there is still a good chance it ends before it’s officially declared.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05013607